Help! My inheritance is in danger of going to my stepfamily.

The stepfamily danger and how to safeguard the position of children with testamentary rights

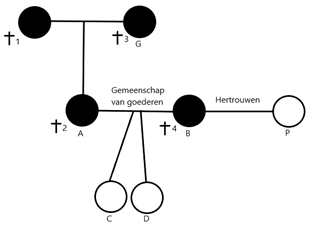

The remarriage of the surviving parent creates the risk that assets from the deceased parent's estate will eventually end up with a stepparent or even with the stepparent's heirs. These assets then disappear from the family.

To prevent this consequence, the law created the so-called "will rights." These allow children to "safeguard" family heirlooms or other assets from the estate of their first deceased parent. By invoking a will right, a child, in principle, acquires a right to transfer assets from the deceased parent's estate. This article explains these will rights in more detail.

Remarriage of surviving parent after death of first parent

If one of the parents in a family with children dies, the 'legal division' applies, unless that parent had made a will and specified otherwise.

The "statutory distribution" is a kind of automatic division of the inheritance between the surviving parent and the children. Under this division, the surviving parent becomes 100% owner of all assets from the deceased parent's estate. However, the surviving parent does incur a debt to the children equal to each parent's share of the inheritance. In principle, this debt is only due upon the death of the surviving parent.

The surviving spouse will thus receive both the assets that were jointly owned by both spouses, as well as the private assets of the first deceased.

This may include objects that came from his or her family, such as the family Bible from 1785, the family silverware and inherited capital, including, for example, the claim that the deceased had on his or her own surviving parent due to the death of that parent.

The remarriage of a surviving parent therefore creates the risk that assets from the estate of the first deceased parent will eventually end up with a stepparent or even the stepparent's heirs. In this way, the assets disappear from the family.

Voluntary rights

The remarriage of a surviving parent therefore creates the risk that assets from the estate of the first deceased parent will eventually end up with a stepparent or even the stepparent's heirs. In this way, the assets disappear from the family.

Example

Suppose that Chris and Denise, following Aart's death, each had a claim on Betty of €35,000, making a combined total of €70,000. Upon Betty's remarriage, they invoke their testamentary rights. They can use this to claim, for example, the Bible, the silver, and the claim on their grandmother Grietje from their mother Betty. This amounts to a total of €50,000. Their claim on Betty would then total €20,000, and they could also claim other assets from Aart's estate for this amount. Betty can, however, reserve the usufruct of these assets. This means that the assets cannot be removed from her during Betty's lifetime. Consequently, the Bible, the silver, and the claim are no longer part of Betty's estate. Therefore, they will not be passed on to Piet.

If Chris and Denise do not invoke this right of consent upon Betty's remarriage (Betty is not obliged to inform the children about the marriage), they can still do so within a reasonable period after Betty's death or the death of the step-parent (Piet).

Testamentary rights are often excluded in a will: why?

In principle, the arrangement of testamentary rights is convenient. Family belongings can remain in the family, and the surviving spouse will not be affected by them due to the usufruct. However, most wills stipulate that these testamentary rights will not apply, or will only apply to a limited extent.

This is done, for example, because there are often no strong family-related assets. It is also often overlooked that the claim against a surviving parent (Grietje) due to the death of a child (Aart) can, through the operation of the statutory division, end up with the surviving spouse (Betty).

Tip: You can prevent this with a good will. We can explain this in more detail.

There's another very important reason why testamentary rights are often (fully or partially) excluded in a will: the law grants children testamentary rights to everything that belonged to their parent's estate. This includes not only private property, but also their share in assets that belonged to the marital community. For example, half the house, half the car, and half the bank account. And if children invoke this testamentary right, they can also claim a portion of these previously joint assets. Thanks to usufruct, the surviving parent doesn't have to relinquish this during their lifetime. However, almost all the normal usufruct rules of the law apply to this usufruct, which limits the surviving parent's use. For example, the usufructuary may live in the home (without compensation), but may not sell the home without the children's consent.

Continue example

Aart has no will (and therefore his testamentary rights are not excluded). Under statutory inheritance law, Chris and Denise can invoke their testamentary rights regarding Aart's inheritance if Betty remarries. This could mean that Betty would have to transfer part of the house to her children. In that case, she would retain the usufruct of the house for as long as she lives. However, if Betty ever wants to sell the house, she would be partly dependent on the children's cooperation.

Summary and tip

The remarriage of a surviving parent creates the risk that family heirlooms from the first deceased parent's estate will eventually end up with a stepparent or even the stepparent's heirs. This can cause these assets to disappear from the family.

This is why testamentary rights were created. Children have the right to take possession of the assets from their deceased parent's estate to pay their share of the inheritance of the first-deceased parent. As long as the surviving parent/stepparent is alive, they have the right to retain the usufruct of these assets. To be able to claim such testamentary rights as a child, they must not be excluded in the will of your first-deceased parent!

If you, as parent(s), intend to draw up a will, be sure to consider these testamentary rights! There are advantages and disadvantages to these testamentary rights, which we can explain during your consultation to determine the most appropriate will for you. It can be very frustrating within a family to declare these testamentary rights inapplicable, or to declare them applicable entirely.

Would you like more advice on this topic? Visit us or give us a call. To schedule an in-office meeting or video call, please call +31 (0)10 44 53 777. We look forward to seeing you.

This article is taken from 'Met Recht Geregeld' (www.metrechtgeregeld.nl), a product of FBN Juristen.

FBN Juristen and MAES civil-law notaries take the utmost care with the content of the articles, but accept no liability for incompleteness or inaccuracy of an article, nor for the consequences thereof.

Services

See also

Why MAES notaries