Am I liable for my spouse's debts if he doesn't pay his debts?

Who is liable if one spouse owes a debt but fails to pay it? Who can the creditor turn to, and which of the spouses' assets can they then "appropriate" because the debt remains unpaid? Does it matter whether the spouses have a prenuptial agreement? This article (part 1) broadly addresses these questions. In part 2, which we will publish later, you can read how liability for debts is regulated in a divorce.

Three types of debt

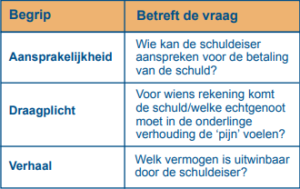

Debts can be divided into three categories: debts incurred for the normal running of the household (1), debts that fall within a marital community (2), and finally, personal debts (3). This distinction is particularly important for the liability of the spouses and for the question of which of the debtor's assets – if the debt is not paid – can be "enforced" by the creditor. Liability means that the spouse can be held liable by the creditor for performance (such as repaying a debt). Liability is independent of the question of who, in the relationship between the spouses, must "bear" the debt, or from which assets the creditor can "recover" the debt.

Who is liable for costs incurred for the normal running of the household (category 1)?

Household expenses include debts incurred for the benefit of the family, such as the cost of food, holidays, housing (e.g. rent or mortgage interest), energy costs, telephone costs and the costs of caring for and raising children (including childcare).

Although spouses are generally required to contribute to household expenses in proportion to their income, they are both liable for all household expenses, including their personal assets. A creditor can therefore recover all of the spouses' assets for the payment of household expenses. Liability for household expenses also applies to spouses who do not have a marital community of property, for example, because they have a prenuptial agreement that excludes marital community of property.

Who is liable for debts that fall within a marital community (category 2)?

If the spouses married without a prenuptial agreement, they are married in a so-called marital community of property (also called a "community of property"). Spouses married before January 1, 2018, have a full community of property. Spouses who married on or after January 1, 2018, unless they have made other arrangements, are married in a "limited" community of property.

Debts that fall under a marital community of property include debts incurred for the purchase of household goods, a car, the costs of less common hobbies, debts incurred in a profession or business, and payroll and income taxes. Regarding these debts, it is important whether they were incurred by spouses married under a full community of property regime (before January 1, 2018) or by spouses married under a limited community of property regime (from January 1, 2018 onward). The debtor spouse can be held liable for payment of the debt.

Married in a community of property; what assets can a creditor appropriate if a joint debt is not paid?

In the case of a full community of property, creditors can recover both the joint assets and the personal assets of the spouse who incurred the debt. The spouse who incurred the debt is, in effect, the one who can be held liable by the creditor (or, in other words, the one who is "liable").

Married in a limited community of property: what assets can a creditor appropriate if a joint debt is not paid?

If spouses married on or after January 1, 2018, the new community of property regime generally applies. Debts related to an inheritance or gift (such as gift and inheritance tax) or debts that existed before the marriage, but not related to jointly acquired property (such as student loans), are not included in the community of property and remain private. These are considered private debts, which will be discussed below.

Community debts can be recovered from both jointly held assets and the debtor's spouse's private assets. If a creditor seeks recovery from private assets, the debtor spouse may designate community assets that offer sufficient recourse. The creditor must then first liquidate these assets.

Who is liable for private debts and what assets can a creditor recover if the debt is not paid (category 3)?

Spouses married in full community of property (before January 1, 2018) have no personal debts, except for debts related to an inheritance or gift to which a personal clause was attached. For personal debts, the spouse who incurred the debt is liable. It is also possible for both spouses to be liable if they incurred the debt jointly. These debts can be recovered from both the community property and the personal property of the debtor spouse.

For spouses married under a limited community of property regime (as of January 1, 2018), debts incurred before the marriage (with the exception of debts incurred jointly in connection with a joint purchase) remain private, as do debts related to an inheritance or gift. One spouse is not liable for the other's private debts, but the creditor can recover assets that form part of the community. This could disadvantage the non-debtor spouse, and therefore, as of January 1, 2018, they have the right to designate assets of the debtor spouse that offer sufficient recourse for the creditor. If these designated private assets do not offer sufficient recourse, the debtor spouse's share in the community can be liquidated. This is therefore limited to half of the assets.

This arrangement remains applicable in the event of a divorce, as long as the joint assets have not yet been divided.

Summary

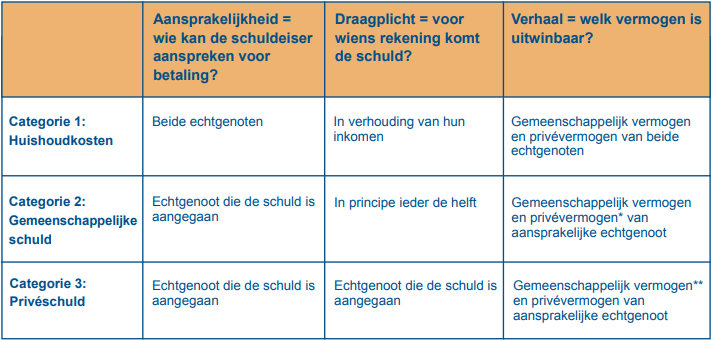

Regarding spouses' liability for debts they have incurred and creditors' ability to recover assets from each other, it is important to know, among other things, how the spouses are married (in community of property or under a prenuptial agreement). Furthermore, it is important to know the debt category, who is liable for the debt, and which assets a creditor can recover. This article describes several debt categories, including the consequences of the marital property regime on their recovery. Below is a diagram outlining liability, obligation to contribute, and recourse regarding the debt categories if the spouses are married in community of property.

Liability and recovery for debts is a complex issue. This must be thoroughly discussed and arranged, both before and during marriage, and also in the event of divorce. In a prenuptial agreement (which you can draw up before marriage, but also during a marriage), spouses can make agreements about the responsibility for debts. Your notary/advisor is an expert in this area and can, of course, advise you on this!

Want to know how debt liability is handled in the event of a divorce? Then read part 2. Part 2 will follow soon.

* If a creditor of a joint debt recovers from private assets, the liable spouse may designate community assets that provide sufficient recourse; the creditor must then first extract these.

**The non-liable spouse has the right to designate private assets of the liable spouse that provide sufficient recourse for the creditor. If these designated private assets do not provide sufficient recourse, only the liable spouse's share in the community property—half of the joint assets—can be extracted.

Tip

When incurring debt, pay close attention to the category of debt you are dealing with. This is important for your (future) liability and the enforceability of your assets against creditors. If you are married under a community of property arrangement, in certain cases a creditor can recover not only the personal assets of the debtor spouse but also the assets of the community. Keep a close record of all existing and future debts so you won't encounter any surprises during or after the marriage. Include agreements regarding debt responsibility in a prenuptial agreement! Get expert advice on this matter from us.

Would you like more advice on this topic? Visit us or give us a call. The consultation is free. To schedule an in-office consultation or a video call, please call +31 (0)10 44 53 777. We look forward to seeing you.

This article is taken from 'Met Recht Geregeld' (www.metrechtgeregeld.nl), a product of FBN Juristen.

FBN Juristen and MAES civil-law notaries take the utmost care with the content of the articles, but accept no liability for incompleteness or inaccuracy of an article, nor for the consequences thereof.

.jpeg)

.jpeg)

Services

See also

Why MAES notaries