Am I liable for my spouse's debts if he doesn't pay them? (Part 2)

Am I liable for my spouse's debts if he doesn't pay them? How was this handled during our marriage, and what happens in the event of a divorce? (Part 2)

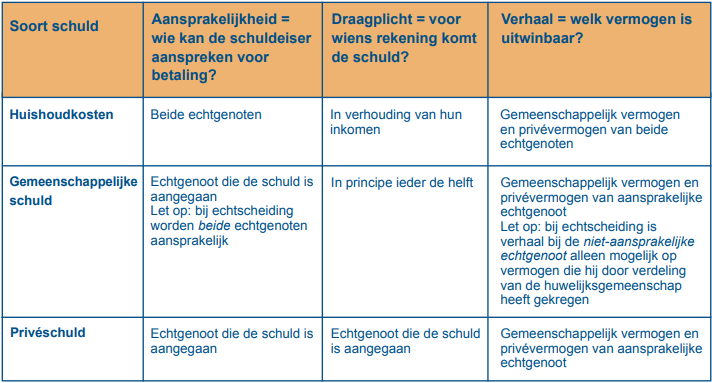

This article addresses liability and the recoverability of assets for spouses' debts in the event of divorce. Part 1 (published on our website on March 24) explained spouses' liability for debts they incurred and creditors' ability to recover their assets during the marriage.

What happens to this liability once a divorce petition has been filed? Can agreements be made about who should pay the debts? These questions are answered in this article.

Liability for debts during the divorce period and afterwards

The answer to the question of who is liable for a debt during the divorce proceedings and after the divorce depends on several circumstances. Liability means that the spouse can be held liable for a performance (such as paying off a debt).

To determine liability, it's important to know, for example, whether the spouses were married in (full) community of property or under a prenuptial agreement excluding any marital community of property (sometimes colloquially called "cold exclusion"). Also important is when the debts were incurred: was this before or during the marriage? And what were the debts incurred for?

In principle, spouses who are married in full community of property (before 1 January 2018) have no private debts: all debts incurred by a spouse alone or by the spouses jointly, before and during the marriage, are community debts (also called 'community debts'), with the exception of debts related to an inheritance or gift to which a private clause was attached.

For spouses married under the so-called limited community of property regime (as of January 1, 2018), debts incurred before the marriage remain private, as do debts related to an inheritance or gift. This is only different for debts incurred jointly in connection with a joint purchase. Despite the fact that these debts were incurred before the marriage, they are considered community debts.

Who is liable for which debts during and after the divorce proceedings?

During a marriage, only that spouse is liable for joint debts incurred by a spouse alone; both spouses are liable for debts incurred jointly. Furthermore, a spouse is jointly and severally liable—that is, with the other spouse for the entire debt—for debts incurred for the normal running of the household.

When divorce proceedings are initiated, the previously existing system of spousal liability is broken. One spouse remains liable for the community debts for which they were already liable before the divorce petition was filed. In addition, one spouse becomes liable for the community debts incurred by the other spouse. This means that the spouse who did not incur the debt can suddenly be held directly liable by the creditor for payment. During and after the divorce, both spouses can be held liable for community debts.

If the debt is not paid, what happens when the spouses' assets are foreclosed?

The fact that each spouse becomes directly liable for all community debts—including debts they did not incur—does not mean that their private assets can be recovered for these debts. A creditor can only recover the assets that this spouse received through the division of the marital community. Their private assets remain unaffected. This does not apply to the spouse who incurred the debt. In that case, the creditor can recover the assets of the marital community that have not yet been divided and the private assets of the spouse who incurred the debt.

Can spouses make agreements about who will pay the debts?

In principle, during and after a divorce, a community debt is shared equally between both spouses. Spouses can make other agreements in a prenuptial agreement or divorce settlement regarding who should be responsible for the debts (also known as the (internal) "debt-bearing obligation"). However, the creditor is not a party to this agreement: liability remains with both spouses unless the creditor releases one of them. The creditor may agree to the debt assumption, but is not required to do so.

Spouses are married in cold exclusion

If spouses are married in cold exclusion, they have entered into a prenuptial agreement in which they exclude any community of property. In other words, the spouses have no joint assets, nor any joint debts. There are only private debts, for which only the spouse who incurred them is liable. Furthermore, only the private assets of that spouse can be seized to pay the debts. However, there is one exception: for debts incurred for the normal running of the household, both spouses are fully liable.

Summary and tip

If spouses are married in community of property and divorce proceedings are initiated, each spouse becomes liable for all community debts, including those incurred by the other spouse.

Direct liability for community debts does not mean that the private assets of the spouse who did not incur the debt can be recovered for these debts. If a creditor demands payment from the spouses and the debt remains unpaid, they can only recover the assets that this spouse/non-debtor received through the division of the marital community. Therefore, their private assets remain unaffected. The creditor can also recover the assets of the marital community that have not yet been divided, as well as the private assets of the debtor spouse. See the diagram below for an overview of the rules regarding debts in a community of property.

Spouses can make agreements in a prenuptial agreement or divorce settlement about who should be responsible for a specific debt (this is also called the obligation to contribute). However, the creditor is not a party to this agreement, so such agreements between spouses do not release them from their liability to the creditor.

During the marriage, keep a close eye on which debts are joint and which are personal. In the event of a divorce, it's wise to inventory all debts in a divorce settlement, which also specifies which debts are for whose account. It's also advisable to make agreements in advance, in the prenuptial agreement, about the division of debts: think before you leap!

It's also possible to draw up a prenuptial agreement during marriage, unless doing so would disadvantage creditors. We can provide you with sound and impartial guidance in drafting a prenuptial agreement and preparing for divorce! Would you like more advice on this topic? Visit us or give us a call. The consultation is free. To schedule an in-office meeting or a video call, please call +31 (0)10 44 53 777. We look forward to seeing you.

Met Recht Geregeld is a product of FBN Juristen. The utmost care has been taken in the preparation of this article, but its limited scope makes it impossible to cover all facets and implications of a topic: this is a general overview. For information about your specific situation, please contact MAES civil-law notaries!

FBN Juristen and MAES civil-law notaries take the utmost care with the content of the articles, but accept no liability for incompleteness or inaccuracy of an article, nor for the consequences thereof.

Services

See also

Why MAES notaries