How do you keep the inheritance within the family?

Even if you have a so-called private or exclusion clause in your will, your inheritance could still go to your child-in-law. Have you made proper arrangements in your will? How can this be prevented?

Many parents want their inheritance to go to their (own) children and subsequently to their grandchildren. Therefore, the family wealth must remain within the family. This desire is evident, for example, in the widespread inclusion of the so-called "exclusion clause" in wills. The exclusion clause is a provision in a will that allows you to stipulate that an inheritance does not fall into your child's marital property. In the event of your child's divorce, what your child inherited from you will not go to your ex-child-in-law.

Such an "exclusion clause" (or "privacy clause") cannot always prevent the inheritance of the first deceased parent from going to that child-in-law. This article discusses the inheritance of (claims from) the inheritance of the first deceased parent and possible solutions to prevent the inheritance from going to your child-in-law in this way.

The claim can still end up with the child-in-law

Example

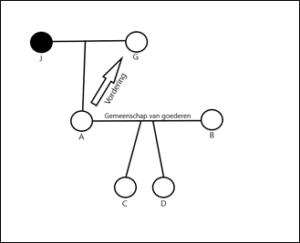

Aart is married to Betty in community of property. They have two children: Chris and Denise. His father, Jan, passed away, and as a result of his death, Aart acquired a claim against his mother, Grietje. This claim is, in other words, Aart's share of his father Jan's estate. As long as his mother, Grietje, is alive, Aart cannot claim this share from his mother. His mother must be able to continue living undisturbed after Jan's death.

Picture for example

Aart's inheritance (hereinafter referred to as "the claim") amounts to €30,000. Aart can therefore only claim this inheritance when his mother, Grietje, dies. His father, Jan, had stipulated in his will, with a so-called "exclusion clause," that Aart's inheritance of €30,000 would not fall within the marital community of property between Aart and his wife, Betty (because they were married in community of property). This sum of money therefore remains, in principle, Aart's private property.

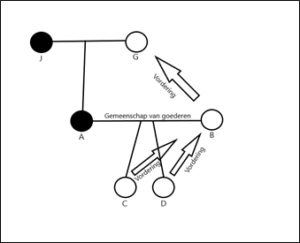

However, things can still go wrong, namely if Aart subsequently dies before his mother, Grietje. If Aart doesn't have a will, the statutory distribution applies to his inheritance. Betty therefore inherits all assets from Aart's estate, including the €30,000 claim against his mother, Grietje. His children, Chris and Denise, are also heirs. Through the statutory distribution, they receive their inheritance in the form of a claim against Betty, which they can only claim after Betty dies. This way, Betty can continue to live undisturbed.

Like Aart, Betty cannot claim the claim on Grietje (which arose from Jan's death) as long as her mother Grietje is alive. However, despite the exclusion clause, the claim has been transferred to Betty.

Picture for example

When Grietje dies, her debts must be paid first. This includes the debt she originally owed Aart, which now belongs to Betty. Betty will therefore receive the €30,000 first. Anything left over will go to Grietje's heirs.

In this example, you see that a child-in-law (Betty) can still receive a portion of the inheritance of a deceased parent-in-law (Jan) due to the rules of the law. This cannot be prevented with an exclusion clause, as is often mistakenly assumed. This can be particularly troubling if daughter-in-law Betty starts a relationship with a new partner soon after Aart's death.

Solutions to keep the inheritance within the family; go to your notary!

A will can help you prevent family assets from passing to a child-in-law. During a will consultation, we will highlight the various options available to you – such as incorporating a two-step bequest – and explain them. In some cases, it may be desirable for your child-in-law to inherit assets from you if your own child predeceases you. For example, if your child-in-law is caring for your (minor) grandchildren and you don't want your child-in-law to suddenly find themselves in financial difficulties due to their death.

A child can also make provisions in their will for the eventuality of predeceased death. For example, they can stipulate that the outstanding claim against their surviving parent will be transferred to their children (in the example above: Chris and Denise) through a legacy.

And there's another lifeline included in the law: the so-called "will rights." These sometimes offer a solution when a new partner comes into the picture. If Betty decides to marry a new partner after Aart's death, Chris and Denise could, for example, use such a will right to claim their inheritance from Grietje. Note: exercising a will right can be expensive. We'd be happy to advise you on this.

Summary and tip

A private or exclusion clause doesn't always prevent a parent's inheritance from (indirectly) going to a child-in-law. When a parent dies, a child often receives their inheritance in the form of a sum of money, which they cannot claim as long as the other parent is still alive. The surviving parent must be able to continue living undisturbed, without having to immediately pay out amounts to their children. In other words, upon the death of a parent, the child usually only receives a claim (equal to their inheritance) against their surviving parent, which they only receive upon the death of that surviving parent.

If the child suddenly dies before their surviving parent, this claim against the surviving parent could, through inheritance law, pass to the child-in-law. There are ways to address this in a will. A will is drawn up by a notary. During a will consultation, we will inform you about the options for keeping an inheritance within the family and highlight the potential advantages and disadvantages of such arrangements.

Would you like more advice on this topic? Visit us or give us a call. The consultation is free. To schedule an in-office consultation or a video call, please call +31 (0)10 44 53 777. We look forward to seeing you.

This article is taken from 'Met Recht Geregeld' (www.metrechtgeregeld.nl), a product of FBN Juristen.

Services

See also

Why MAES notaries